Ontario Corporate Tax Rate 2025

Ontario Corporate Tax Rate 2025. Manufacturing and processing tax rate: Federal and provincial/territorial tax rates for income earned by a general corporation—2025 and 2025.

The following tables show the general and small business corporate income tax rates federally and for each province and territory, as well as the small business limits. No personal or corporate income tax changes, except:

How each provincial party leader will handle Ontario’s corporate tax, The current corporate income tax rates for 2025 are outlined below: The minister anticipates a deficit of ca$1.3 billioni for 2025/24 and projects surpluses of $0.2 billion in.

2019 Provincial Tax Rates Frontier Centre For Public Policy, Simplifying the ontario computer animation. No changes to corporate tax rates were announced in the budget, leaving corporate tax rates for 2025 as follows:

Tax rates for the 2025 year of assessment Just One Lap, The following table shows the income tax rates and business limits for provinces and territories (except quebec and alberta, which do not have corporation tax collection. The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5%.

Tax Rate In Canada 2025 Hot Sex Picture, The following table shows the general and small business corporate income tax rates federally and for each province and territory for. No corporate income tax rate changes were announced in this year’s budget.

Complete Guide to Canadian Marginal Tax Rates in 2025 Kalfa Law, The following table shows the income tax rates and business limits for provinces and territories (except quebec and alberta, which do not have corporation tax collection. 2025 corporate income tax rates.

Corporate tax definition and meaning Market Business News, Manufacturing and processing tax rate: Ontario 2025 and 2025 tax rates & tax brackets.

Wake Forest Business & Industry Partnership, Current as of march 31, 2025. Information for corporations about ontario income tax (basic rate, minimum tax, special additional tax, capital tax, tax credits).

Tasas combinadas de impuestos corporativos estatales y federales en, The current corporate income tax rates for 2025 are outlined below: General corporate tax rate 2,3.

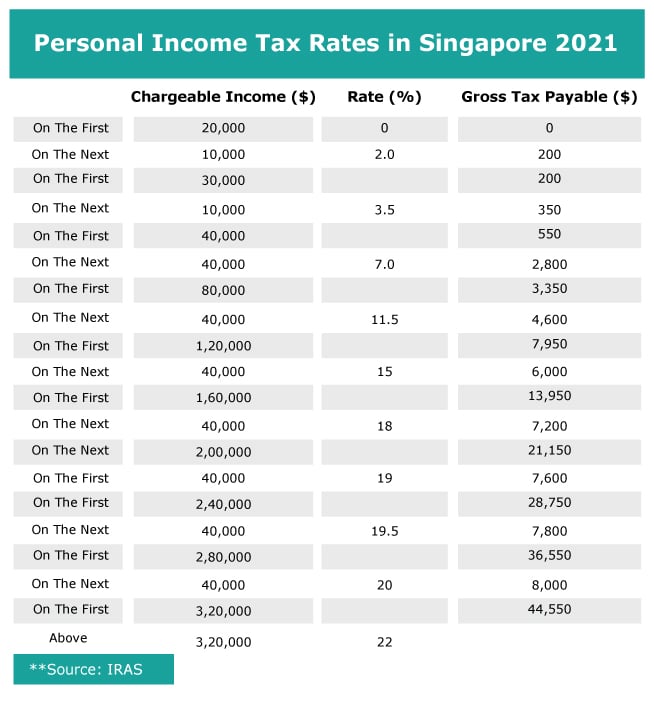

Singapore Corporate Tax Rate Singapore Taxation Guide 2025, The small business rates are the. Ontario 2025 and 2025 tax rates & tax brackets.

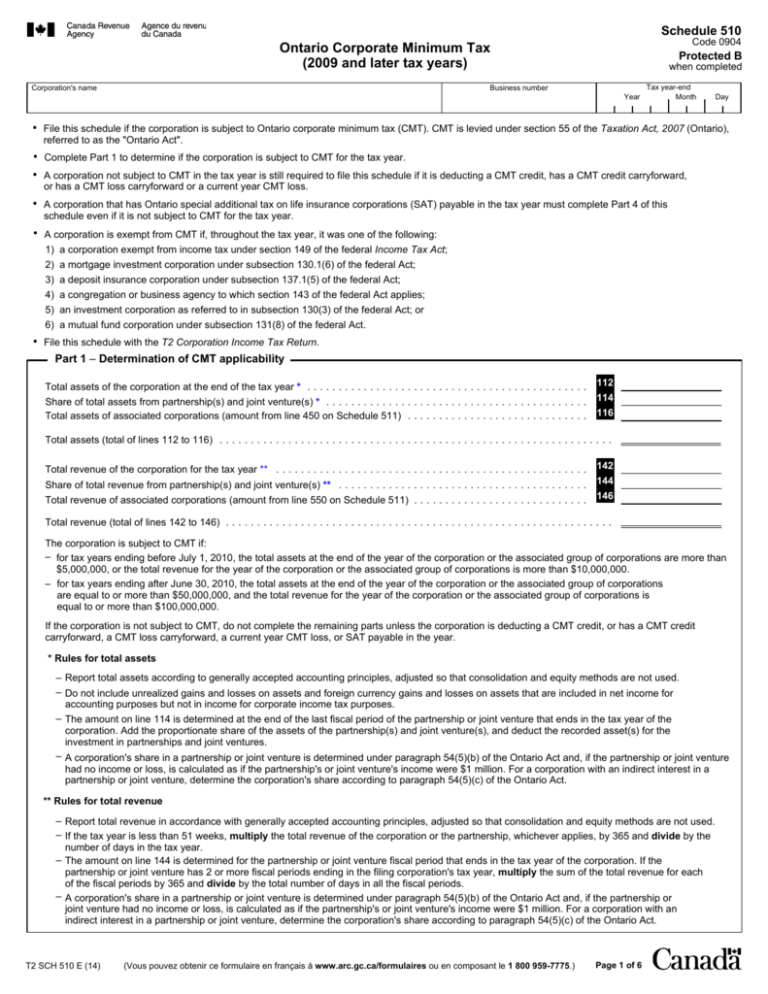

ONTARIO CORPORATE MINIMUM TAX (2009, Generally, corporations carrying on business through a permanent establishment in ontario are subject to both federal and ontario corporate income taxes. No personal or corporate income tax changes, except: