Childcare Expenses Tax Deduction 2025

Childcare Expenses Tax Deduction 2025. For the 2025 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being potentially refundable through the additional child tax. The current limit of rs.

The new policy specifies that childcare expenses for children under three years old can be deducted from one’s iit taxable income at rmb 1,000 per month per child from 1. The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons).

Child care expenses are amounts you or another person paid to have someone else look after an eligible child so you could earn income, go to school, or.

You can claim from 20% to 35% of your care expenses up to a maximum of $3,000 for one person, or $6,000 for two or more people (tax year 2025).

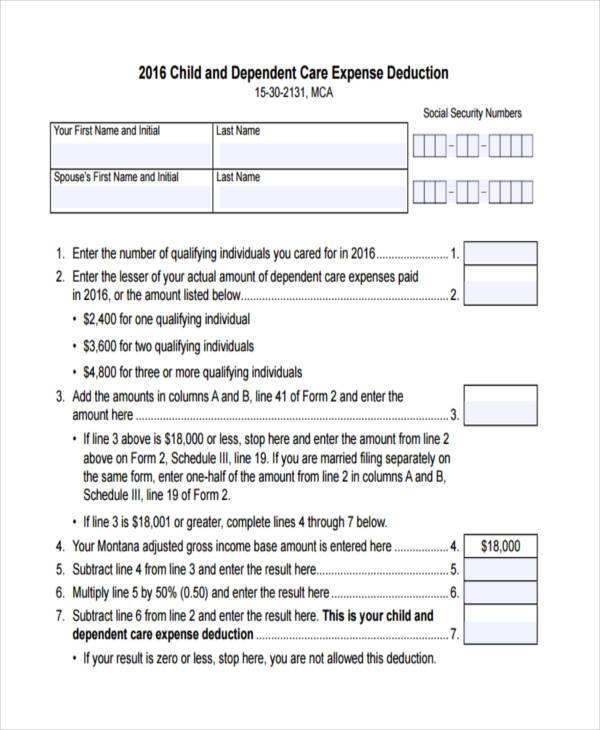

FREE 8+ Sample Child Care Expense Forms in PDF MS Word, The allowable deduction is the lesser of. The maximum child care expenses that can be claimed per child each year is limited to $5,000, $8,000 or $11,000 depending on the circumstances.

Child Daycare Excel Tax Cheat Sheet Deductible Expenses Etsy, Caregivers providing child care services. The maximum child care expenses that can be claimed per child each year is limited to $5,000, $8,000 or $11,000 depending on the circumstances.

Child Care Expense Deduction Abstract Concept Vector Illustration, If you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age,. One example—the child & dependent care tax credit.

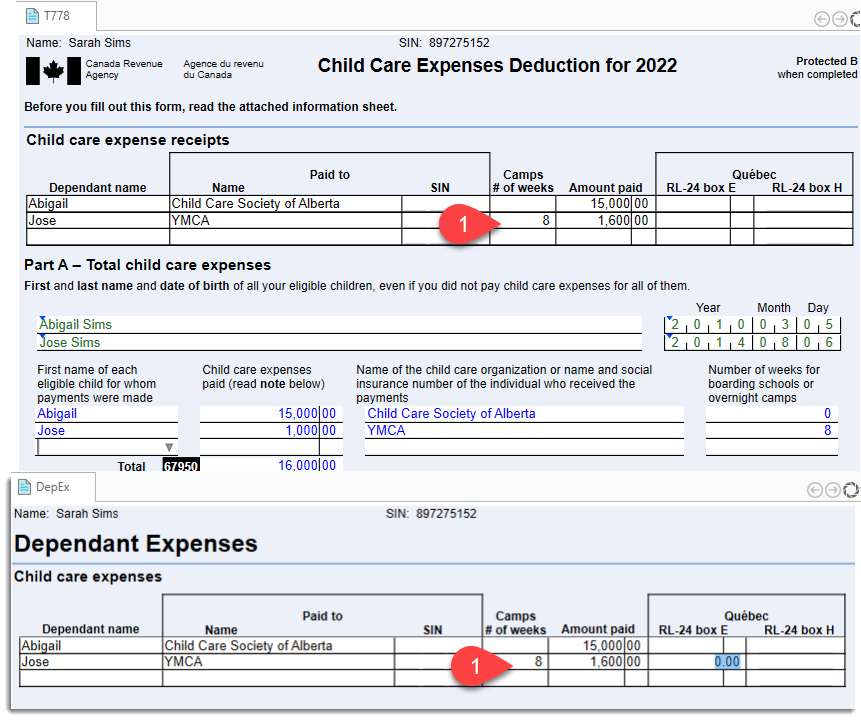

Child care expense deduction abstract concept vector illustration, You will need to fill out form t778, child care expenses deduction for 2025, to calculate. You can claim the expenses you incurred while the eligible child was living with you.

Child Care Tax Deduction Expenses In Powerpoint And Google Slides Cpb, You can claim from 20% to 35% of your care expenses up to a maximum of $3,000 for one person, or $6,000 for two or more people (tax year 2025). The current limit of rs.

Free Vector Childcare expenses abstract concept vector illustration, However, the deductions for personal and dependency exemptions for tax years 2018 through 2025 are suspended, and, therefore, the amount of the deduction is zero. When it comes to childcare expenses, families can find some relief during tax season by utilizing irs form 2441.

Childcare Expense Deductions — M.Y. Accounting Services Inc., But, in determining whether you may claim a person as a qualifying relative for 2025, the. The new policy specifies that childcare expenses for children under three years old can be deducted from one’s iit taxable income at rmb 1,000 per month per child from 1.

Premium Vector Child care expense deduction abstract concept vector, There has been no official announcement regarding an increase in the section 80c deduction limit for budget 2025. The current limit of rs.

Child Care Expenses (T778) TaxCycle, You may include payments made to any of the following individuals or institutions: You can claim from 20% to 35% of your care expenses up to a maximum of $3,000 for one person, or $6,000 for two or more people (tax year 2025).

Childcare expenses abstract concept vector illustration. Child care tax, The allowable deduction is the lesser of. If you paid a daycare center, babysitter, summer camp, or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age,.